maryland electric vehicle tax incentive

Maryland also has an incentive that allows electric vehicles to use high-occupancy vehicle HOV lanes no matter how many passengers are in the car. Solar and Energy Storage.

Ev Tax Credit Calculator Forbes Wheels

The total amount of funding that is available for the fiscal year 2021 July 1 2020 to June 30 2021 is 1800000.

. For more information. Electric Vehicle Supply Equipment EVSE Information Limit One Per Individual per Property EVSE Manufacturer EVSE Level Select one EVSE Model B1 EVSE Equipment Cost B2 EVSE Installation Cost B3 Total EVSE Cost B1B2 B4 Multiply B3 by 040 B5 Rebate Amount Lesser of 700 or B4. The Maryland Office of the Comptroller has determined that based on IRS rules a State voucher is considered taxable income related to the Motor Carrier or Manufacturer as it relates to leased vehicles.

SMECO Energy Rates July 2022 Residential. If you have questions regarding submitted applications andor their status please contact evsemeamarylandgov. Utility companies Pepco Potomac Edison Baltimore Gas and Electric BGE and Delmarva Power have each partnered with the state government to offer a 300 rebate for purchasing and installing an approved level 2 smart.

Maryland offers individuals who purchase or lease a qualifying plug-in electric vehicle a one-time excise PEV tax credit of up to 3000 while funds last. Funds for the Maryland excise tax credit usually run out early each fiscal year. Applicants are then put on a wait list until the next round of funding is released.

Federal EV Tax Credit. Qualified PEV purchasers may apply for a tax credit against the imposed excise tax up to 3000. 5 rows The credit is for 10 of the cost of the qualified vehicle up to 2500.

Charge Ahead rebate of 5000 for purchase or lease of a new or used electric vehicle with a base price under 50000 for eligible customers. Marylanders who purchased a plug-in electric vehicle since funds were depleted for the 3000 state excise tax credit have been waiting to see if the legislature will reauthorize funding for the program. The Maryland Energy Administration MEA manages grants loans rebates and tax incentives designed to help attain Maryla nds Goals in energy reduction renewable energy climate action and green jobs.

Most if not all of the utility companies in Maryland offer a 300 rebate towards the purchase of a qualifying Level 2 charger that allows for time of use data sharing with the utility. For more general program information contact MEA by email at mikejonesmarylandgov or by phone at 410-537-4071 to speak with Mike Jones MEA Transportation Program Manager. Maryland Zero Emission - Electric Vehicle Infrastructure Council.

The Clean Cars Act of 2017 signed into law by Governor Larry Hogan authorized an excise tax credit on plug-in electric cars for three years from July 1 2017 to June 30 2020. Reduces consumption of imported petroleum by providing. The Maryland legislature also has a bill to revive funding for the states electric vehicle state excise tax incentive worth up to 3000 for electric vehicles or plug-in hybrids.

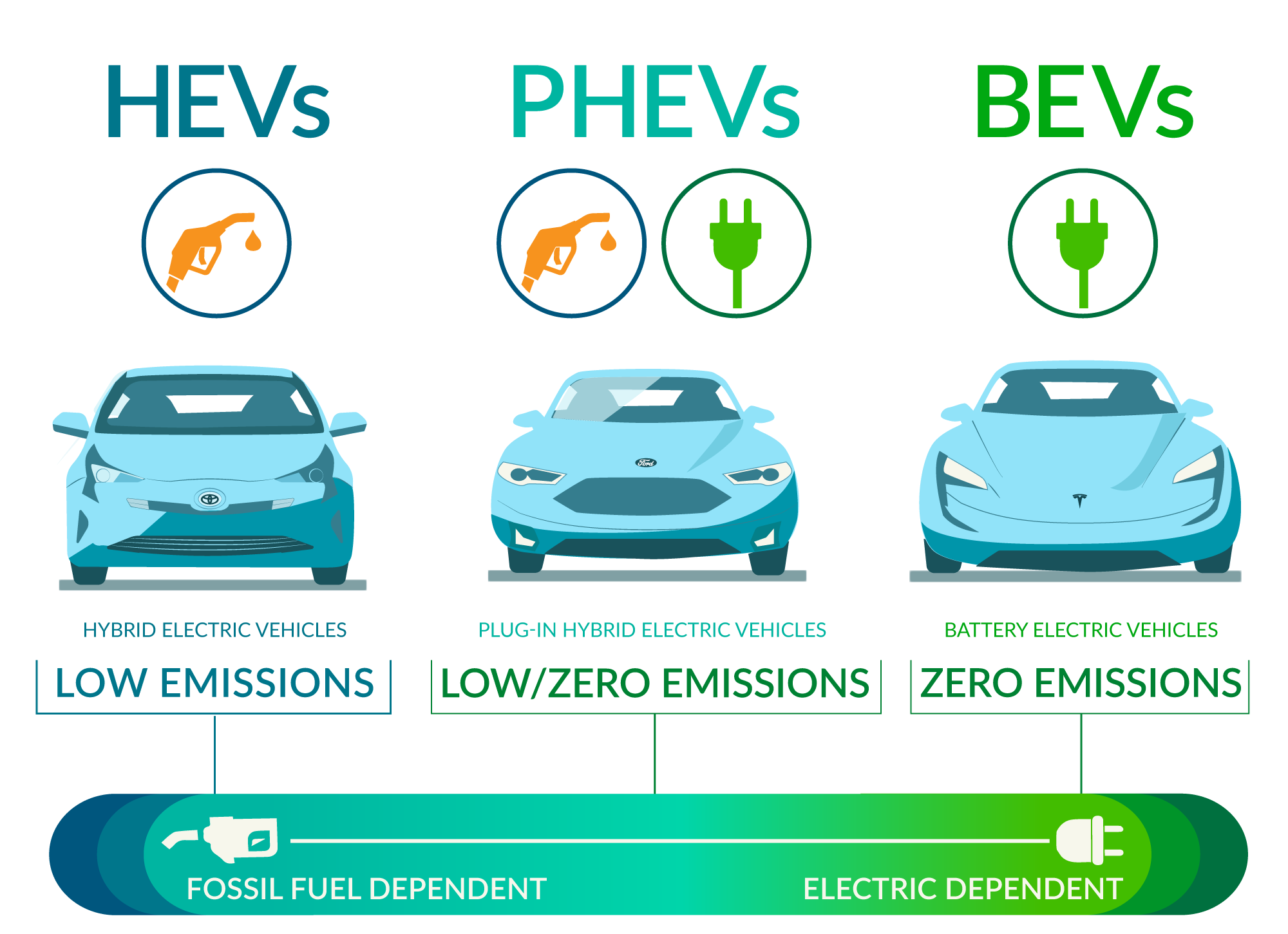

Read below for incentives available to Maryland citizens and businesses that purchase or lease these vehicles. EV and hybrid vehicle purchase incentives do benefit from some bipartisan support in Maryland and throughout the country. The credit ranges from 2500 to 7500.

Maryland EV Tax Credit. Marylands incentive program Electric Vehicle Supply Equipment EVSE Rebate Program 20 grants rebates to individuals for home use businesses for employees and customers and retail service stations. As an approved vendor with multiple utilities well guide you through the entire process.

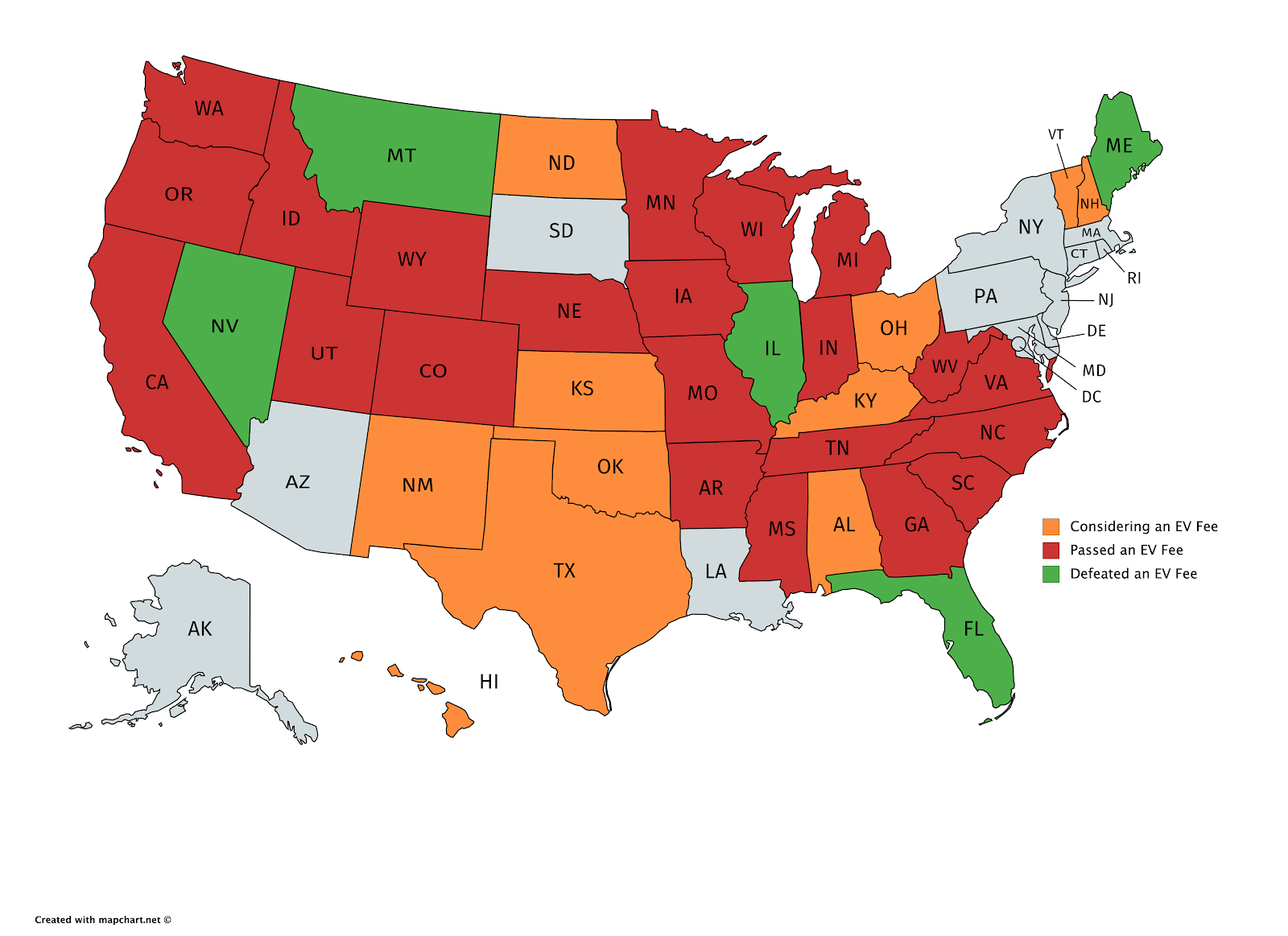

EV and hybrid vehicle purchase incentives do benefit from some bipartisan support in Maryland and throughout the country. In addition the state of Maryland offers vehicle vouchers equipment rebates and free travel on HOV lanes. The Maryland electric vehicle incentive EVsmart can help you to save 300 on your electric or plug-in hybrid electric vehicle expenses.

Federal Income Tax Credit A federal tax credit is available to buyers of new plug-in electric vehicles based on battery capacity and ranges. President Bidens EV tax credit builds on top of the existing federal EV incentive. Even local businesses get a break if they qualify.

View the Latest Promotions on Nissans Award Winning Lineup. Tax Status of Electric Truck Vouchers. January 5 2021 Lanny.

4 rows Clean Fuels Incentive Program CFIP. The tax break is also good for up to 10 company vehicles. The base amount of 4000 plus 3500 if the battery pack is at least 40 kilowatt-hours remains the same.

The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles. The Maryland legislature also has a bill to revive funding for the states electric vehicle state excise tax incentive worth up to 3000 for electric vehicles or plug-in hybrids. Some dealers may offer additional incentives.

Through the programs below MEA helps Maryland residents businesses non-profits and local governments implement energy. Return to menu Charging EV Charging Types and Locations. Complete instructions on how to apply for the Maryland EVSE Rebate are located on the MEA Program page.

The Maryland electric vehicle incentive EVsmart can help you to save 300 on your electric or plug-in hybrid electric vehicle expenses. Purchasers were encouraged to file a form to reserve a place in the. First Name Last Name Phone Number Business Email.

For model year 2021 the credit for some vehicles are as follows. The rebate amount for residential charging stations is 40 of the equipment purchase price and installation cost up to 700. Incentives When purchasing an EV there are many state and federal tax incentives that essentially reduce the price tag.

Effective July 1 2023 through June 30 2027 an individual may be entitled to receive an excise tax credit on a qualifying zero-emission plug-in electric or fuel cell electric vehicle regardless of whether you own or lease the vehicle. Standard Rebate of 2500 for purchase or lease of a new electric vehicle with a base price under 50000. Maryland Excise Tax Credit up to a maximum of 3000 for Electric Vehicle or Plug-in Hybrid.

Therefore a Form 1099-G will be issued for vouchers received through the Maryland Electric Truck MET Voucher Program. Maryland EV Tax Credit Extension Proposed in Clean Cars Act of 2021.

What S In The White House Plan To Expand Electric Car Charging Network Npr

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price

Kamala Harris Attacked For Struggling To Charge An Ev She Can T Even Put A Plug Into A Car

Electric Car Tax Credits What S Available Energysage

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

A Breakdown Of The Us Ev Market By State Shows More Incentives Equals More Sales Jato

Incentives Maryland Electric Vehicle Tax Credits And Rebates

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

Investing In Charging Infrastructure For Plug In Electric Vehicles Center For American Progress

Don T Be Fooled Annual Fees On Electric Vehicle Drivers Are Not Fair Sierra Club

Ev 101 What You Need To Know About Electric Vehicles

A Breakdown Of The Us Ev Market By State Shows More Incentives Equals More Sales Jato

Ev 101 What You Need To Know About Electric Vehicles

Electric Cars Vs Gas Cars Cost In Each State Self Financial

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra